Tax Office homing in on property deductions, SMSFs warned

With property deductions a big focus for the ATO this tax time, SMSFs have been warned on some of the pitfalls in this area that can land them in trouble.

With property deductions a big focus for the ATO this tax time, SMSFs have been warned on some of the pitfalls in this area that can land them in trouble.

Tax benefits attract miscreants, but non-arm’s length rules should allow minor transgressions to be fixed, says CA ANZ.

With interest-only loans no longer an option the commercial incentive for sub-trusts ends, says the Tax Institute.

Search through the data collected by the Australian Bureau of Statistics, and find interesting facts about how the country is changing.

ATO update on trust distributions outlines key features of low and high-risk arrangements.

A written business plan is essential to help you start and grow your business

Beneficiaries are urged to understand the tax effect of entitlements in the wake of a recent High Court decision.

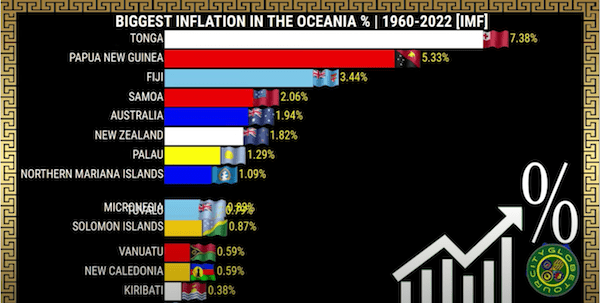

See how the inflation rates changed from 1960-2022

First update was in January 2022, now phase 2.

The more detail you can give your accountant the quicker your tax return can be processed and,

usually, the better the outcome. The following will help.

Select your desired option below to share a direct link to this page