Looming changes for the “buy now, pay later” market

The Federal Government has released a consultation paper seeking views on options to

regulate the “buy now, pay later” (BNPL) market.

The Federal Government has released a consultation paper seeking views on options to

regulate the “buy now, pay later” (BNPL) market.

Don’t clean out the garage. Forget that lapsed gym membership. Here are 5 new year’s resolutions to keep if you want to stay on top of your tax and super in 2023.

After the Christmas and new year break, it is quite possible that some employers may have missed the

due date for the December 2022 quarter superannuation guarantee contributions (SCG) payment of

29th January 2023.

The latest figures from the ABS reveal economic growth last year and show inflation coming off its peak.

Around 100,000 SMSF directors still need to apply for their director ID despite the deadline passing two months ago. Extensions are available for legitimate reasons.

The largest portion of the SMSF investment pool is held in domestic shares, according to a recent survey.

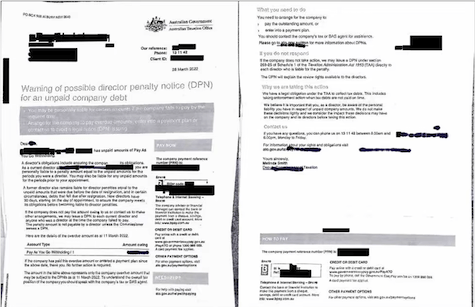

After a slow start in May, figures show how the office went up through the gears with director penalty notices.

With illegal early access schemes on the rise, the Tax Office has issued a fact sheet warning super members about the promoters of these schemes.

The ATO fails to resolve the key question of what constitutes “ordinary family and commercial dealing”, tax professionals say.

Select your desired option below to share a direct link to this page