State and Federal COVID-19 support — February – 2022

The following links are to the latest state and federal government plans, schemes, programs, and initiatives to help businesses and individuals manage the impact of yet more COVID-19 restrictions.

The following links are to the latest state and federal government plans, schemes, programs, and initiatives to help businesses and individuals manage the impact of yet more COVID-19 restrictions.

ATO second commissioner Jeremy Hirschhorn has outlined the Tax Office’s commitment to ensuring a business-led recovery continues in the Australian market in the 2022 calendar year.

Single Touch Payroll will be expanded from 1st January 2022, with additional requirements.

On 1 July 2021, the maximum number of allowable members within an SMSF increased from four people to six people.

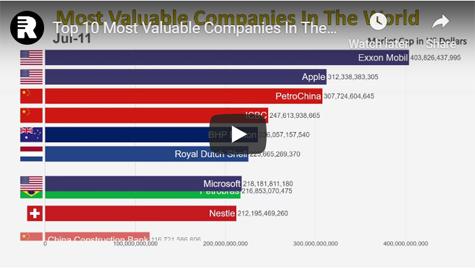

A very interesting, graphical, summary of the monsters of our global economy. Fascinating stuff!!

The number of SMEs struggling due to late payments is still being felt, according to new research.

The ATO and the SMSF Association have clarified some of the areas of confusion with respect to the director identification number process and outlined some of the ATO’s longer-term plans.

Imagine this scenario: George, who lives in Melbourne and is aged 23, gets a call from his grandmother in Athens. Grandma says she is going to give him $100,000 for Christmas. George is ecstatic. With profuse thankfulness, George gives Grandma the bank details.

The following links are to the latest state and federal government plans, schemes, programs, and initiatives to help businesses and individuals manage the impact of yet more COVID-19 restrictions.

The growth trajectory of more Millennial SMSFs is set to continue in the years to come, according to the chief executive of Smarter SMSF.

Select your desired option below to share a direct link to this page